how to pay indiana state withholding tax

1 2022 A county with an asterisk has changed. Call 317-232-5500 for more information.

State Income Tax Rates Highest Lowest 2021 Changes

INtax is no longer available and has moved to INTIME DORs new e-service portal at intimedoringov.

. Accessing from Employee Center. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. For employers who pay employees in Indiana use this guide to learn whats required to start running payroll while keeping compliant with state payroll tax regulations.

Make a payment in person at one of DORs district offices using cash exact change only personal or cashiers check money order and debitcredit cards fees apply Call DOR Customer Service and make a payment over the phone using your debitcredit card fees apply Payment plans You can set up a payment plan if you owe more than 100. INTIME now offers the ability to manage all tax accounts in one convenient location 247. The county tax rate will depend on where the employee resided as of January 1.

If the business cannot locate the REG-1 form you may call us at 317-232-2240 Monday through Friday 8 am430 pm ET. Departmental Notice 1 explains how to withhold taxes on employees. Late filed returns are subject to a penalty of up to 20 and a minimum penalty of 5.

You can find your amount due and pay online using the intimedoringov electronic payment system. Businesses can close their tax accounts on INTIMEIf a business does not have an INTIME account then it is required to send an Indiana Tax Closure Request Form BC-100If the tax account isnt closed on INTIME or the BC-100 isnt filed DOR may continue to send bills for estimated taxes. If an employee resides out of state on January 1 but has his or her principal place of work or business in an Indiana county the withholding agent should withhold for.

As an employer you must match this tax dollar-for-dollar. Payment Plan Set up a payment plan online. That means no matter how much you make youre taxed at the same rate.

For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. To learn more about the EFT program please download and read the EFT Information Guide. After the tax bill is paid in full the business must file a REG-1 form that is mailed to the business.

Indiana counties local tax rates range from 050 to 290. Companies who pay employees in Indiana must register with the IN Department of Revenue for a Taxpayer ID Number and the IN Department of Workforce Development for a SUTAAccount Number. All counties in Indiana impose their own local income tax rates in addition to the state rate that everyone must pay.

Pay Taxes Electronically Customers can quickly and securely pay their taxes electronically. How to Register To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government. This includes filing returns making payments setting up payment plans viewing refund amounts and secure messaging with DOR customer service.

If a business does not pay its tax liability the RRMC will expire. These tables divide the dollar amount of the exemptiondependent exemption by the number of pay periods. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales as well as tire fees fuel taxes wireless prepaid fees food and beverage taxes and county innkeepers.

Estimated payments can be made by one of the following methods. The computation of Indiana payroll tax is simple Determine Gross Income xxxxxxxx Less iThe personal exemption allowed xxxxx ii The dependent exemption allowed xxxxxx Taxable Income xxxxxxx Indiana State income tax Taxable income00323 Indian county tax Taxable income x county tax rate Indiana Personal Dependent Exemptions. Any penalties and interest that accrue from missed tax payments.

Be aware that closing a business with DOR does not end your obligations to. You must also match this tax. For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year.

Without this information OnPay will be unable to file or deposit any Indiana tax payments for your company. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. For the feds.

Unlike the federal income tax system rates do not vary based on income level. EFT allows our business customers to quickly and securely pay their taxes. Using a preprinted estimated tax voucher that is issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax Paying online Filling out ES-40.

Indiana businesses have to pay taxes at the state and federal levels. If you have any questions about the withholding of state or county taxes please contact the department at 317 232-2240. Rates do increase however based on geography.

INBIZ Indianas one-stop resource for registering and managing your business and ensuring it complies with. Indiana County Tax Rates Effective Jan. IN Taxpayer ID Number.

Indiana has a flat state income tax rate of 323 for the 2021 tax year which means that all Indiana residents pay the same percentage of their income in state taxes. Residents of Indiana are taxed at a flat state income rate of 323. Late filed WH-3s are subject to a penalty of 10 per withholding document W-2 1099 K-1.

INtax supports the following tax types. While some tax obligations must be paid with EFT several thousand businesses use the program for its speed and convenience. Indiana counties local tax rates range from 050 to 290.

Calculating Your Withholding Tax Inside Indiana Business

Dor Indiana S Tax Dollars At Work

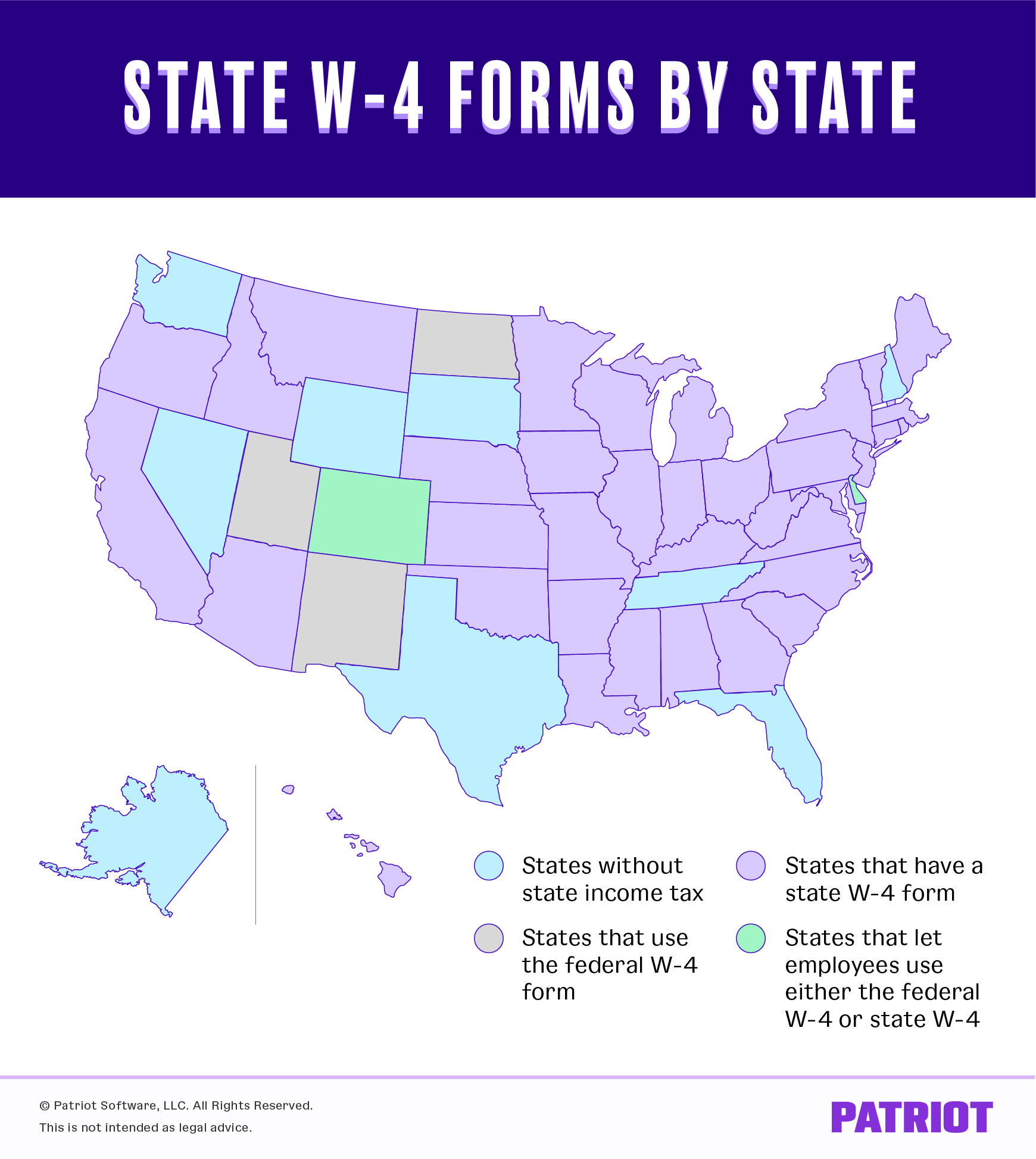

State W 4 Form Detailed Withholding Forms By State Chart

Navigating State Withholding Requirements For Nonresident Employees Wolters Kluwer

State W 4 Form Detailed Withholding Forms By State Chart

State W 4 Form Detailed Withholding Forms By State Chart

Can I Print My Own Payroll Checks On Blank Check Stock Welcome To 1099 Etc Com Payroll Checks Printing Software Writing Software

I Live In One State Work In Another Where Do I Pay Taxes Picnic S Blog

Sales Tax By State Is Saas Taxable Taxjar

Solved Indiana Withholding Setup In Quickbooks Payroll

Solved Indiana Withholding Setup In Quickbooks Payroll

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

A Basic Overview Of Indiana S Wh 4 Form For State Tax Withholding

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Pay Indiana Taxes With Dor Intime R Indiana

Purdue University Degree Pu Diploma Buy Fake Purdue University Degree Buy Fake Pu Diploma University Degree Free Certificate Templates Usa University